A few years ago, sending and receding money from overseas was a hustle. You had to deal with bank wire transfers that would charge you exorbitant exchange rates and fees.

Today receiving and sending money even from the remotest part of the continent is a breeze – provided the sender or the receiver has an internet connection.

Thanks to online payment processing services such as PayPal and Payoneer that give you easy and cost-effective means to make local and international payments.

While there are other digital payment services such as Skrill, Neteller, Stripe, and Transferwise, PayPal and Payoneer are the two most popular online payment processors with the largest market share.

Apart from that, these two platforms provide services to over 200 countries across the globe.

Table Of Contents

You are now probably asking yourself, which payment processing service is better between the two? Well, in this article, we will examine different parameters that differentiate PayPal from Payoneer and Payoneer from PayPal.

But before we dive into the details, let’s have a brief overview of PayPal and Payoneer.

A Brief Overview of PayPal

Founded in 1998, then known as Confinity, PayPal is an American E-Commerce company that specializes in digital money transfers. In 2000, Confinity joined hands with X.com to form PayPal.

In 2002, the company had its initial public offering. Later that year, after watching the company become the premier choice for online shoppers, vendors, affiliate bloggers, and freelancers, eBay, an internet auction company, acquired PayPal at the cost of $1.5 billion.

In 2015, eBay spun off PayPal into a separate publicly-traded company. Since its inception, the company has allowed users to exchange money between accounts and make payments online in a secure platform.

Currently, PayPal allows users to link their accounts to their own bank accounts, making it easy and more efficient to transfer payments in various currencies compared to checks or money orders. It supports over 20 currencies and is available in more than 200 countries.

Following a sophisticated series of security advancements, the company has grown to become the first choice payment processing platform due to its superior anti-hacking and anti-phishing measures.

For example, users can request a refund if they’ve been cheated. What’s more, the company takes security very seriously. Therefore, whenever they detect a suspicious transaction, they can deactivate the account pending further investigation.

A Brief Overview of Payoneer

Payoneer is a digital payment services company with headquarters in New York, United States. The company was founded by an Israeli businessman, Yuval Tal in 2005, and has since grown to be one of the most preferred online financial services company by businesses, affiliate marketers, and freelancers.

The company offers services to over 200 countries and territories and allows transactions in over 150 different currencies.

The company works by offering its partner companies and clients with prepaid MasterCard cards, which are shipped to their respective owners in different countries, including businesses, freelancers and affiliate marketers.

Once you receive the card, you’ll be required to activate it in order to receive payments. There are two ways to withdraw funds via Payoneer.

The first method is through the prepaid MasterCard. With the prepaid MasterCard, you do not need to have a bank account.

So once your funds are sent, you can withdraw them within 24 hours in just the same way you would use your regular credit card. You can also use the card to shop online.

The second method is by linking your Payoneer account with your local bank account details. Once the funds are in your Payoneer account you can transfer them to your bank account.

This will allow you to withdraw the money in your local currency and with low fees. Just like the MasterCard method, the funds should be available in your local account within 24 hours.

Some common companies that use Payoneer to send mass payments include Amazon, Upwork, Google, and Airbnb. One reason that makes Payoneer a preferred choice by most businesses is its simple integration with any website.

PayPal vs Payoneer

Setting up a PayPal account

If you do not already have a PayPal account, and you would like to have one, follow the following steps. Note that setting up a PayPal account is free and should only take you a few minutes. You might also want to have a bank account to link with your PayPal account.

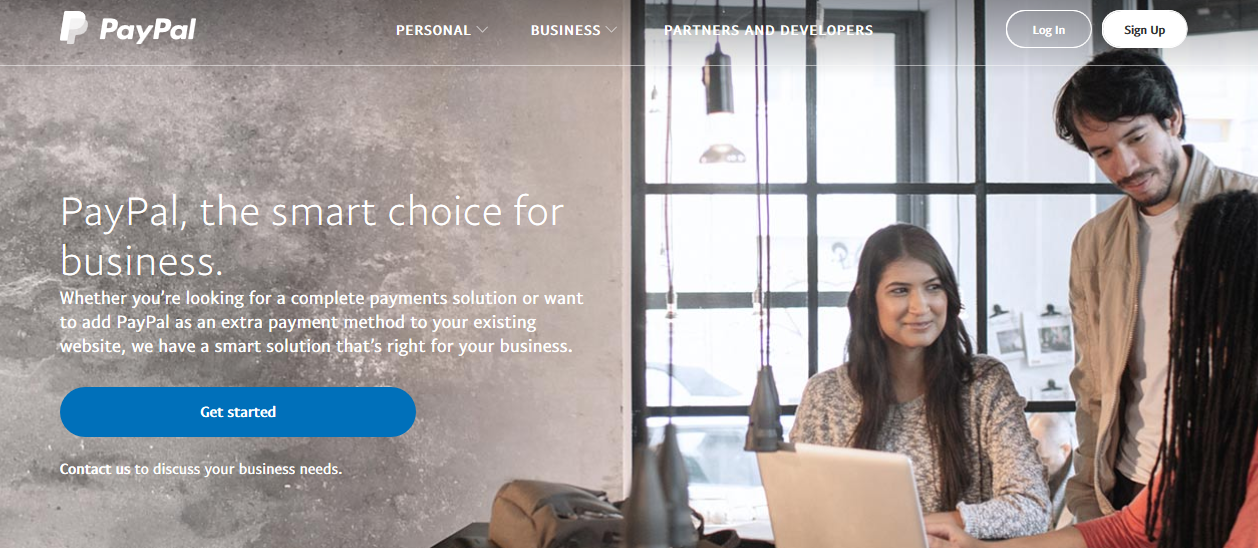

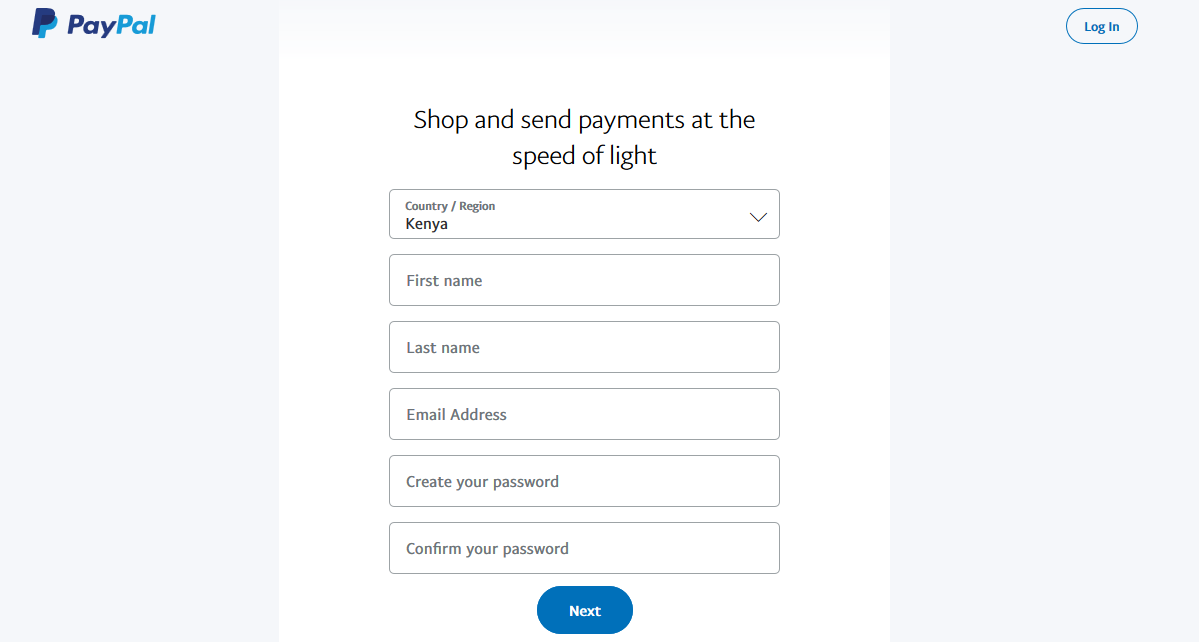

Step #1: Go to the PayPal homepage.

Step #2: On the top right corner, click on Sign Up.

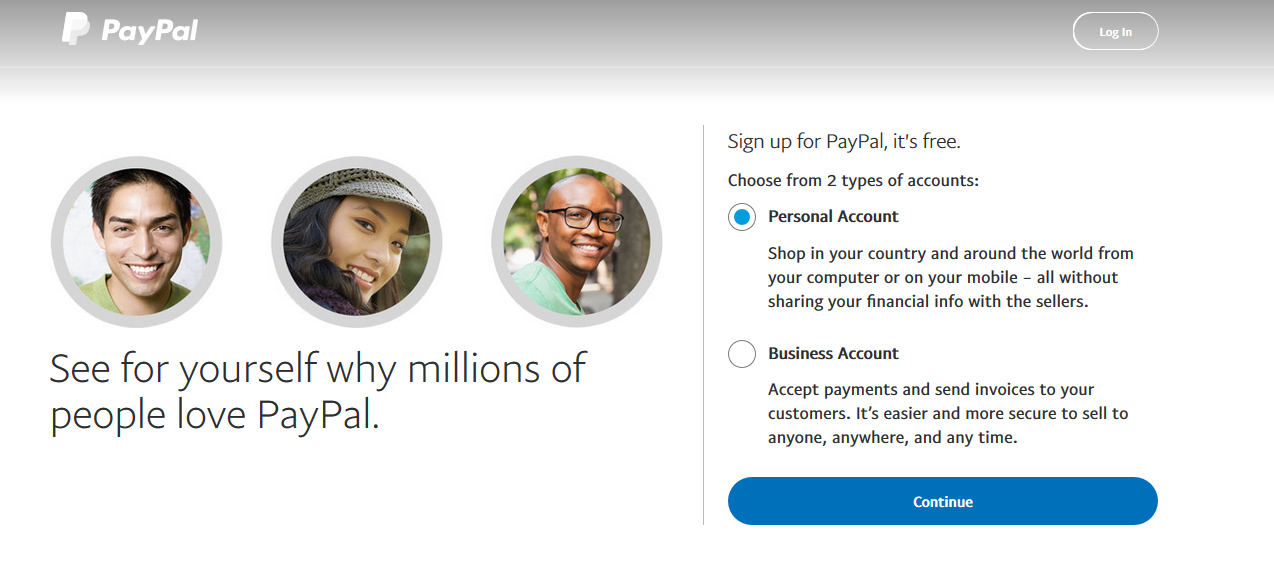

Step #3: On the following screen, select whether you want to create a business or personal account. Then click continue.

Step #4: On the next screen, enter your details such as your Country, Names, Email address, and password. Once you are done click or tap on Next.

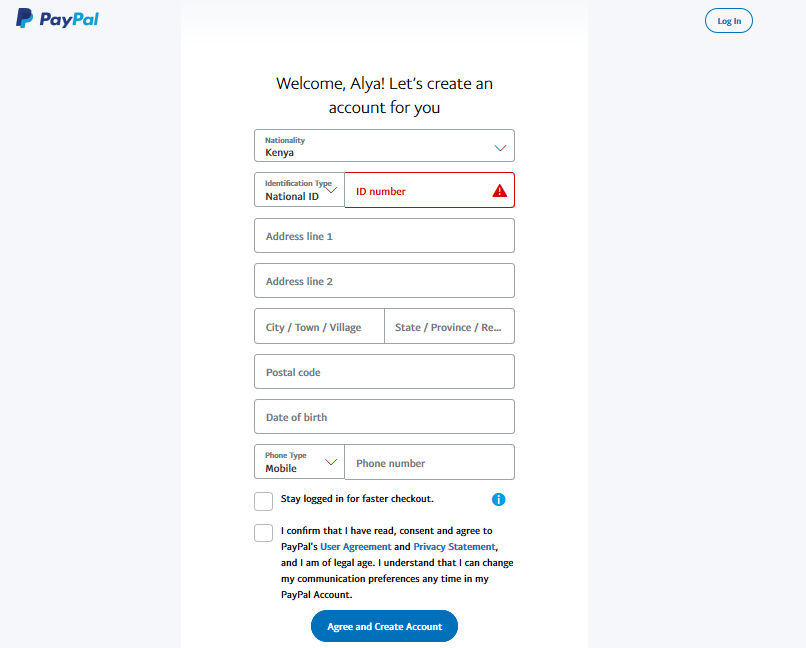

Step #5: On the next page, you’ll be required to provide your identification number, your address, date of birth, and your mobile number. Note that this information is mandatory and must be provided for your account to be created.

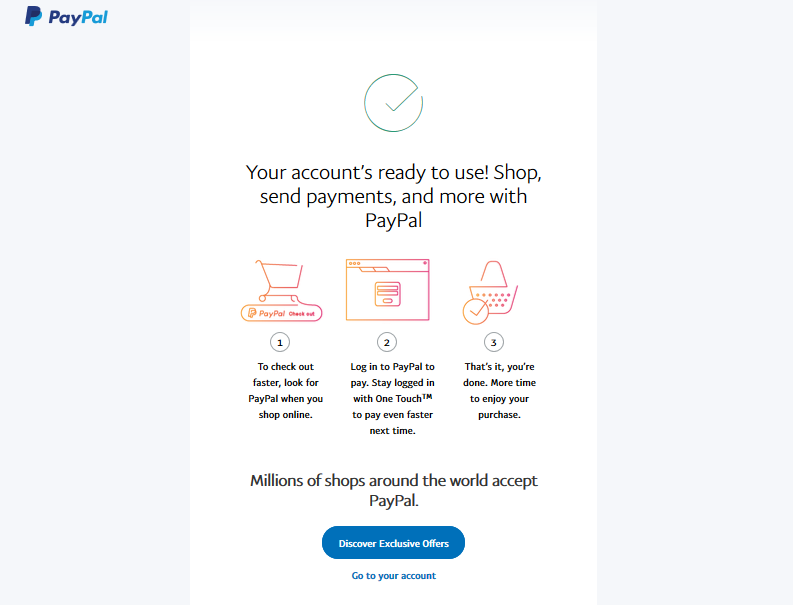

Step #6: Once you are done click on Agree and Create Account. You can choose whether you want to start shopping, sending or receiving payments online via PayPal.

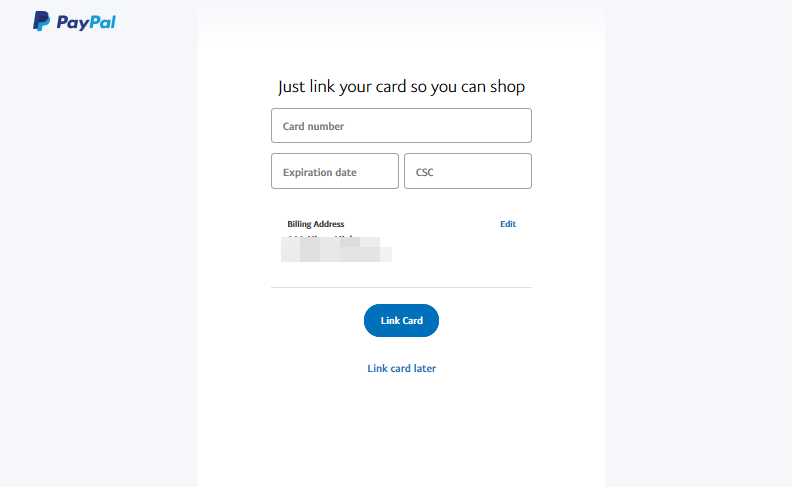

Step #7: You can now choose to link your card or link it later (this step is optional). However, if you plan to receive or transfer money to your bank account you’ll need to add this important detail. Note that for your card to be verified, it will take at least three days.

Setting up a Payoneer account

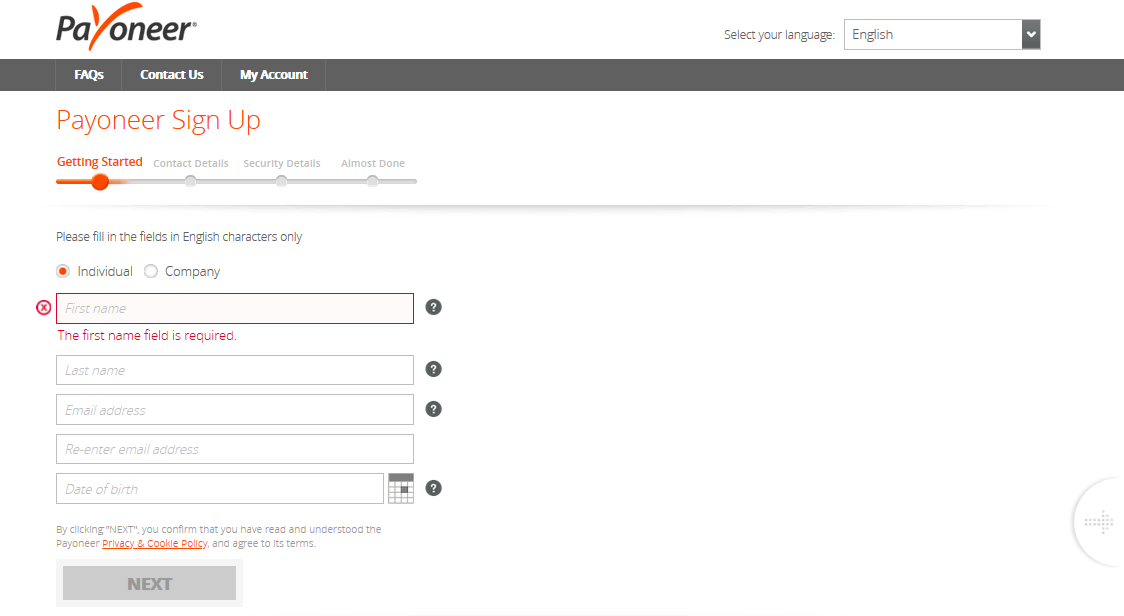

Just like PayPal, creating a Payoneer account is free. So if you do not already have the account, here are a few steps to follow and get your account in no time.

Step #1: Visit the Payoneer homepage.

Step #2: On the top right-hand corner, click on Register.

Step #3: On the next page, enter your name and email address then click “Next.”

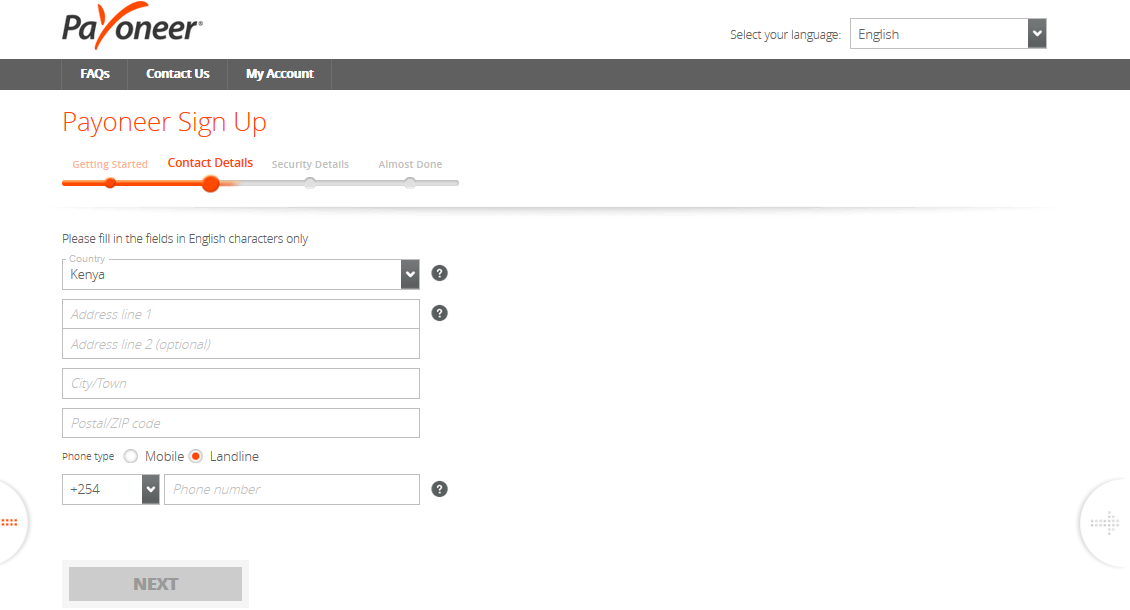

Step #4: On the page that follows, you’ll be required to enter your address and mobile number. Then click “Next” once you are done.

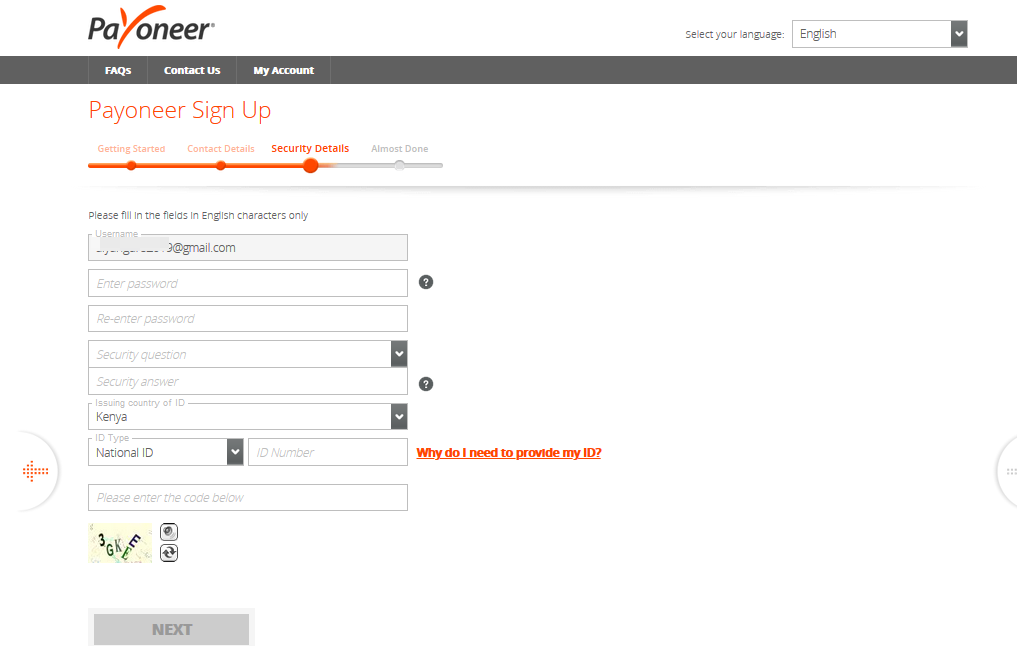

Step #5: On the next sign up page, enter your security details. This includes the password that you will use with the account and your national identification number, and answer a security question.

Note that you can also use your passport or driver’s license number in place of your ID. Click Next.

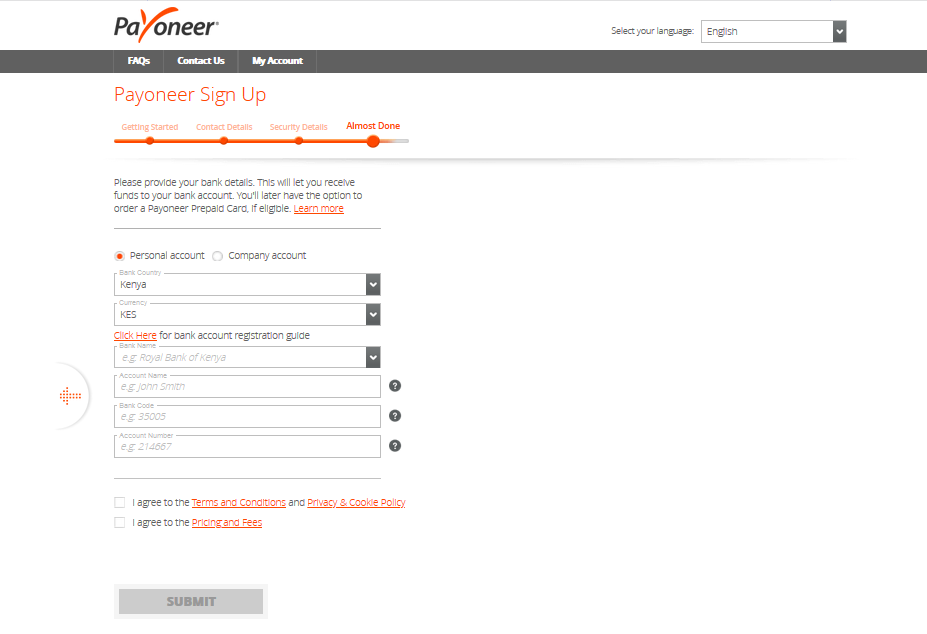

Step #6: At this stage, you are almost done. The only thing you’ll be required to do is enter your bank details, including your local currency. Click submit for your account to be reviewed.

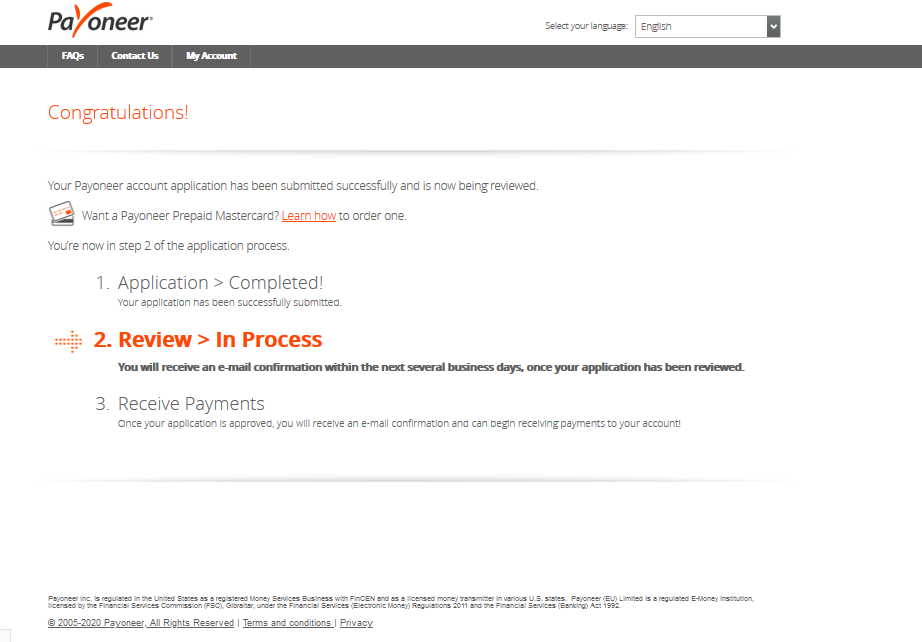

The review process takes a few business days. Once approved, you’ll get a confirmation email in your email address and you can now start receiving payments in your account. You can then apply for your prepaid MasterCard to enable you to withdraw your funds.

Now let’s learn how both PayPal and Payoneer compare in terms of features and other parameters.

PayPal vs. Payoneer – An In-depth Comparison

While both services excel in certain scenarios, they also do have their pitfalls. Therefore, if you are going to choose one over the other, it’s vital that you evaluate them on a case by case basis. Let’s look at the different scenarios.

Fees and Exchange Rates

When it comes to fees or exchange rates both services differ to a huge extent. Your choice here will primarily be based on your personal circumstance and type of transaction you want to make.

With PayPal, the transaction fees are dependent on the country in which your account is signed up. In the United States, for example, PayPal charges zero fees to transfer funds from your PayPal account. However, if you wish to pay with your credit card, debit card, or PayPal credit, a fee of 2.9% + $0.30 applies for each transaction you make.

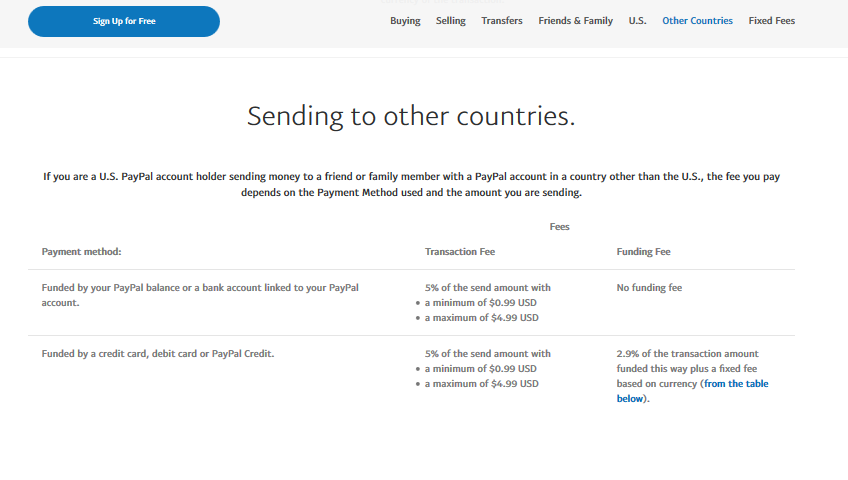

For international transactions (that is, transactions made from the US to another country), fees may vary depending on the destination, payment method used, and the amount you are sending.

For example, if you are sending from your PayPal account balance or the bank account linked to your account, a transaction fee of 5% will apply to the sent amount per transaction. This means you’ll pay anywhere between $0.99 and $4.99.

If you choose to transact with your debit card, credit card, or PayPal Credit, you’ll be slapped with an additional fee of 2.9% on top of the transaction fee plus a fixed fee based on currency. Remember you’ll also have to incur a 2.5% currency conversion fee.

Payoneer, on the other hand, does not charge any fees to send or receive money from other Payoneer customers. However, if you receive funds into your local account in USD, AUD, CAD, GBP, EUR, and MXN a fee of between 0-1% for USD but it will vary from which country the funds originate from.

If you choose to receive funds directly from your customers via debit or credit card, you’ll have to incur a 3% fee.

If you use eCheck in USD, you’ll have to pay a 1% fee. Fees for money sent via marketplaces and networks such as Upwork, Airbnb, Fiverr and any other company via Payoneer may vary. Currency conversion rates with Payoneer stand at 2% over the mid-market exchange rate.

Security

Whenever you want to transact online, the first thing that comes to your mind is the security of your funds. You always want to ensure that both your personal information and funds are safe and secure.

Fortunately, both PayPal and Payoneer rely on high encryption levels to ensure the safety of their clients’ funds and information. This means that no third party can manipulate or see any undertakings in your account.

Payoneer, for example, ensures that each transaction is strongly protected by strong encryption to ensure that each data is unreadable and is protected by secured firewalls.

They also monitor each transaction to ensure that there is no identity theft, phishing, fraud or other attacks. You also get email notifications if any unusual activity is detected within your account.

PayPal, on the other hand, uses next-level encryption to ensure that your transactions are heavily guarded. They also monitor every transaction to prevent fraud and identity theft. They also have a buyer and seller protection center in case of claims and chargebacks.

Speed

When it comes to speed in processing global mass payouts and withdrawals, Payoneer beats PayPal hands down.

With PayPal, for example, you have to initiate every withdrawal manually if you need to get cash in your bank account. This makes the process cumbersome and time-consuming. What’s more, the funds can take between 3 to 5 days to reflect on your bank account.

Payoneer, on the other hand, eliminates such hassles of having to wait too long to receive your funds. Through their Global Bank Transfer service, you are able to receive your cash in local currency to your bank account within 24 hours once you receive your payment since the entire process is automated.

In addition, Payoneer’s daily withdrawal limits are higher, summing up to $5000 compared to PayPal’s $500 per month for unverified accounts. You can, however, lift your PayPal withdrawal limits by linking your account with your bank, verifying your debit or credit card, and by providing your social security number.

Debit/Travel Cards

Both companies offer their customers with cards for them to be able to access their funds in a faster and more convenient manner. However, the availability of these cards, and especially PayPal’s Cash MasterCard is dependent on your location.

Mobile Applications

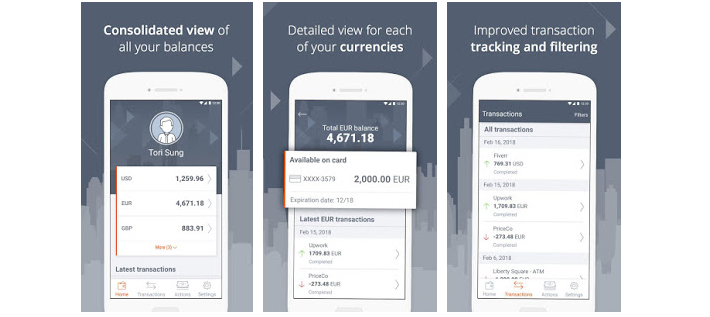

With the growth of mobile technology, it’s hard to find a financial services company that does not offer a mobile app. PayPal and Payoneer are no exceptions from this bandwagon. And given that their services are strictly offered online, they both offer mobile apps for both iOS and Android devices so users can be able to send and receive money safely and securely while on the go.

The mobile app’s security is very advanced such that you can use your fingerprint for easy login. Also, if your account is accessed from an authorized device, you will be alerted.

The only limitation with both the mobile apps is that you can only do the basics tasks like viewing your balances, view transaction details, send, and accept payments.

PayPal vs. Payoneer – Key Takeaways

- Both platforms offer a secure and easy online payment for both businesses and individuals. So you don’t have to worry about your personal information getting shared or your funds getting lost.

- PayPal fees are higher compared to Payoneer, which means that you can save a significant amount of money when you transact huge amounts of money with Payoneer.

- You can send professional invoices using both platforms.

- Both services are easy to integrate with e-commerce sites.

- For mass payouts and B2B payouts, Payoneer makes the process simple since the entire process is automated.

- You can create a virtual US/UK bank account with Payoneer for receiving funds.

Wrapping Up

The decision on which payment option is the best is a question of circumstance and how much money you want to transact. For example, if you live in a country or region where only a few banks offer PayPal withdrawal services, you might opt for Payoneer.

Similarly, if you own a website and most of your customers prefer paying for your products via PayPal as opposed to Payoneer, you will definitely opt for PayPal.

However, if you are just looking for an online payment service that will save you money in the long run, our best bet is Payoneer thanks to their low transaction fees and exchange rates.

The decision, however, is up to you to choose which service fits you better. We recommend that you do further research before settling on either of the services.